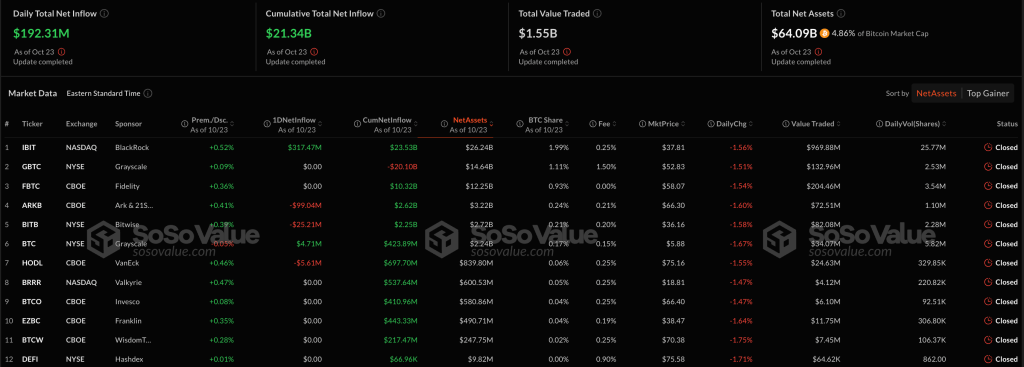

A new day brings another influx of capital into BlackRock’s IBIT Bitcoin ETF, and correspondingly, more cryptocurrency purchases by the hedge fund giant for its own wallet. According to SoSo Value, the IBIT Bitcoin ETF saw over $317 million in inflows in the past 24 hours. In comparison, the previous day’s inflows totaled $42.98 million, meaning the inflows literally surged by more than 737% in just one day.

This steady inflow into BlackRock’s ETF has continued for nearly two weeks. During this period, IBIT has raised a staggering $2 billion.

Naturally, such inflows into the ETF are accompanied by cryptocurrency purchases from the issuer in equal amounts.

BlackRock’s Bitcoin

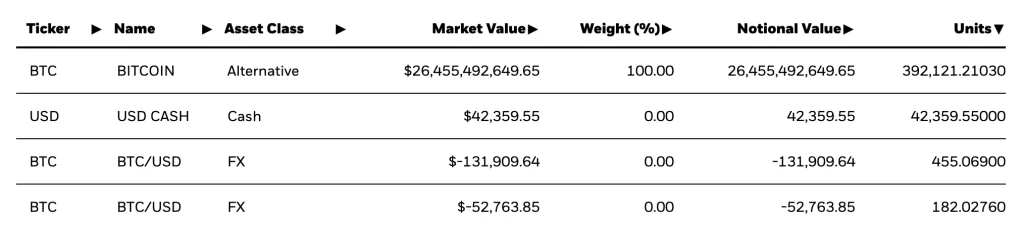

For example, before today’s $317 million net inflow data, it was known that BlackRock’s iShares Bitcoin Trust ETF held 392.1212103 BTC as collateral. At current prices, this amounts to approximately $26.27 billion. With the new inflows, it’s clear that this amount will exceed $27 billion today, with an additional approximately 637 BTC.

As long as inflows into the Bitcoin ETF continue, we can expect BlackRock to keep absorbing the market. Already one of the largest holders of cryptocurrency in general, it seems this ETF is merely a pretext, and the hedge fund’s real interest lies in owning Bitcoin itself.