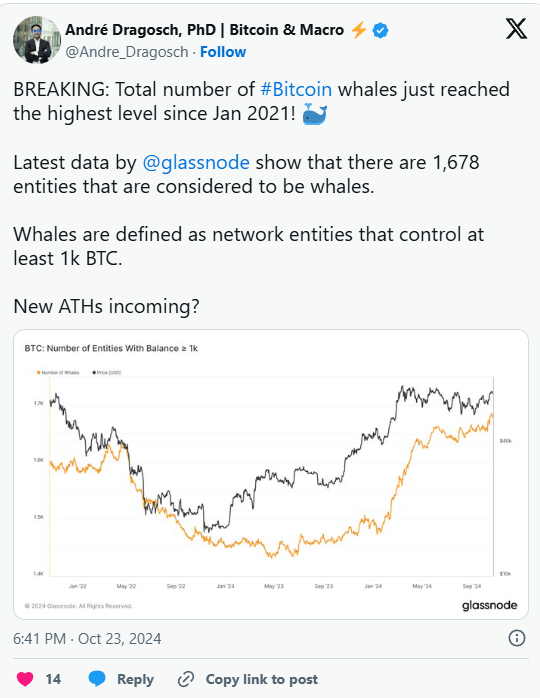

Data from Glassnode and André Dragosch of Bitwise shows that the number of Bitcoin whales, entities holding at least 1,000 BTC, has surged to 1,678 earlier this week, marking the highest level since January 2021.

The accumulation by large investors and the strong interest in U.S. spot ETFs reflect growing confidence in Bitcoin’s price outlook. Whales, with their ability to influence liquidity and pricing, are closely monitored due to their significant impact on the market.

According to CryptoQuant, as Bitcoin approaches $70,000, retail investor accumulation has slowed, increasing by only 1,000 BTC over the past 30 days—the slowest rate ever observed. Since the beginning of 2024, larger investors (holding 1,000 to 10,000 BTC) have increased their holdings faster than retail, with 173,000 BTC compared to 30,000 BTC from retail.

Bitcoin is currently trading above $67,000, nearing a new high of $73,800, after reaching $69,000 on Monday before pulling back. Some analysts expect BTC to continue climbing, with key levels to watch being $80,000 and $100,000.